This article has been UPDATED, check the latest news at the bottom.

This article contains all of the important information you need to know regarding sales taxes and VAT in Orion. Starting with the next payment we are introducing sales taxes and VAT. What you will be charged depends on your location, state or country rules and regulation on tax.

Here is what you need to know.

At ManageWP we like to make sure we do business the right way, we don’t like to avoid paying tax or try jump through hoops. Those of you who have been with us, you will remember that in the Classic we required Europeans to pay VAT. Orion has helped us scale our business, and we are glad you are making the most out of our platform. However, after having discussed Orion’s future with our expert legal team, we have decided to carry on with VAT, and on top of that introduce sales tax for US citizens. At this point it is necessary to charge both. This means that on top of our prices, your total monthly bill, you are required to pay tax in the amount set by your state or country.

We only ask for your address, so that the correct tax amount can be applied.

How To Add Your Address

What this means for you is a one step process where we will ask you to add in your address to our payment information. By doing so, our system will be able to identify where you pay tax and charge you accordingly.

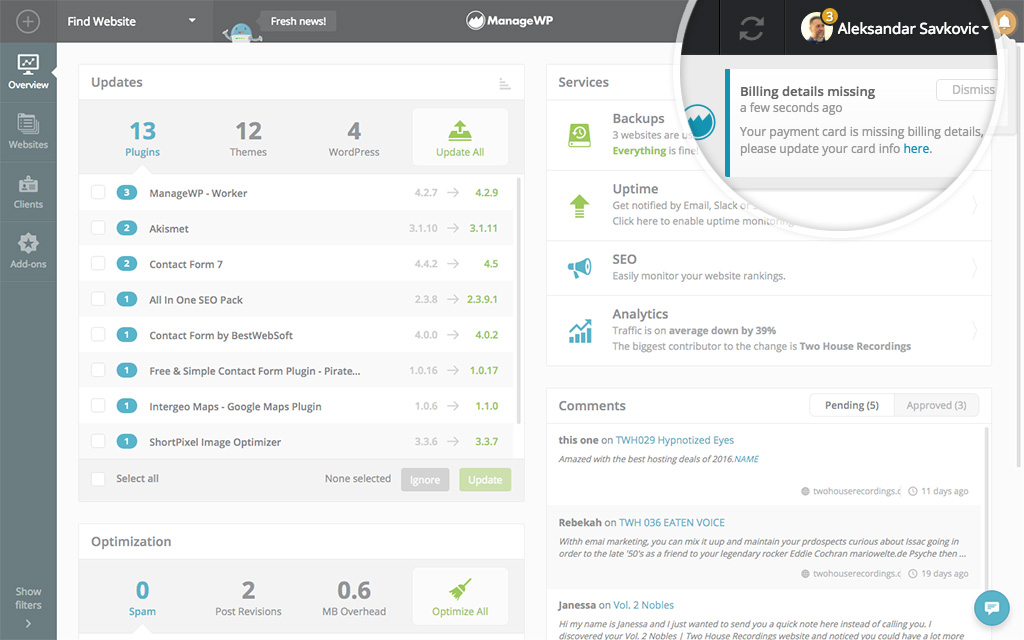

We have created a notification for you so if you see it pop up on our notification bell, you can click on it directly and it will take you to a window where you can fill in your details.

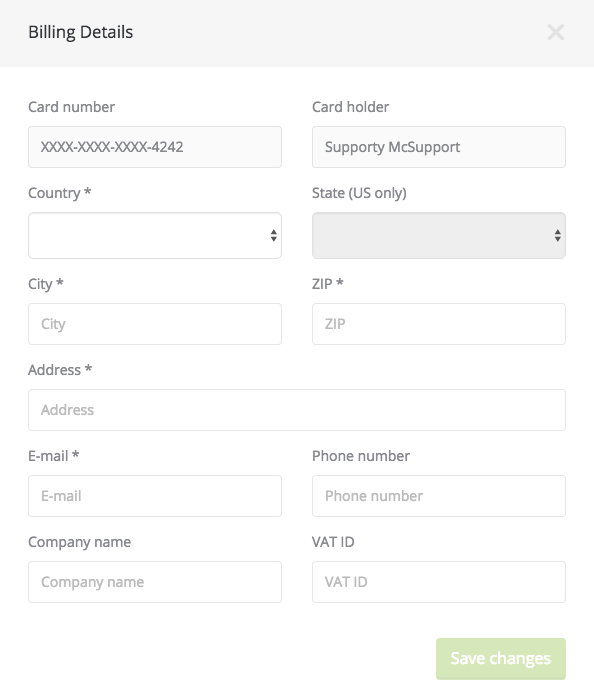

Here is what you need to fill out.

Here is what you need to fill out.

Please note that the state field applies to US citizens only, if you have selected another country, but still need to write down a state write it down in the adress line.

Adding Your Address Is Compulsory

It’s important to note that starting September 5, it is compulsory to add your address otherwise we will not be able to bill you. That will result in us being forced to disable your premium add-ons, until you fill in all of the required information.

Please note that if your company has VAT ID, there is an option to fill in this field and you will be exempt from a VAT charge.

Summary

Starting September 5 we require all of our paying customers to fill out their address in our payment window, so that tax can be applied to their payments. Thank you all for your understanding, and like always our support team is with you 24/7 for any additional questions and worries you might have.

UPDATES

Here is the latest information regarding sales taxes. You can expect the sales tax to be implemented at the latest by September 20, for the month of August. We have been experiencing some technical difficulties with the implementation itself, we expect to have everything up and running next week. The issue lies with the tax calculations when generating the invoice. Just to reassure you around 99% of all ManageWP users wont be asked to pay any tax, there are a few exceptions for EU citizens paying VAT. Unless you have a VAT ID, you will have VAT charges added. When the technicalities get fixed, you can expect to see invoices on the 1st of each month, and to be charged by the 5th.

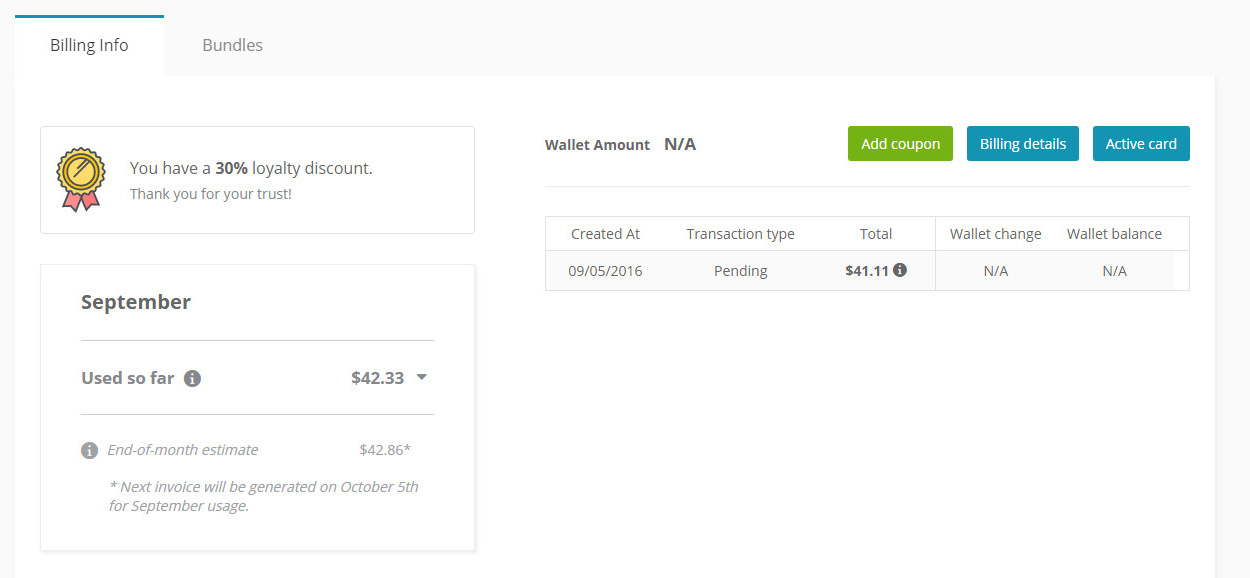

Here is a preview of what invoices look like and where to find them. They can be found by hovering over your username at the top right, and clicking on billing.

Please note, because of all of the recent changes and legacy transfers, the figure you will see might be higher than what you should pay. If you think there has been a mistake, open up a support ticket and we will fix it for you.

mike

Where the USA tax and the VAT Tax comes into play is when You ManageWP pay us, not that we pay you. If you are located in our State like California in the US and we pay you for a Service there is no Sales Tax needed because you do not have a physical product you are a service only.

We have issues with affiliate products being sold and location to the company with the product like Amazon, etc.

1lifeincome

As a business owner I’m use to being taxed. Just a ? as to what for. So, this does Not bother me. Legal compliance allows me to generate revenue w/out being hindered by the respective governmental authorities. I Can’t wait for Trump to reduce my corporate tax rate.

ttownsend

I think its great that MWP will be increasing with physical presence in the US and unfortunately for US citizens running a business means having having to pay taxes too. I do see the point as Marcel mentioned as most US States do have provision for non-taxation of Services. What might prove helpful is having your MWP team put together a list (spreadsheet or DL PDF) that can be posted for reference by State for Tax Compliance. I will start by providing mine (http://dor.myflorida.com/dor/taxes/sales_tax.html and http://www.floridasalestax.com/Florida-Tax-Law-Blog/2012/May/WHAT-SERVICES-ARE-SUBJECT-TO-SALES-TAX-IN-FLORID.aspx) Since the services you provide are not a physical product they as well as my services fall under “Management Services” and within the State of Florida are NOT taxable unless they are associated with a Physical Property such as Real Estate. You may have many Orion users that are not aware of their own tax laws (sad but true) providing a link might be helpful.

Nemanja Aleksic

Thanks for the explanation, Tom!

I think I saw somewhere that every item/service in the US can have up to 10,000 different tax rates, since they’re determined both on state and local level. And to think they said our pricing is complicated 🙂

We’re working on adding more information in the coming weeks, since this whole tax thing is a recent addition.

marcel

Hold on. You are providing a service, not a product. Sales tax is not required for services in the state of Illinois (and most other states that I am aware of). I know this because the idea of taxing services in this state has been proposed by politicians and soundly rejected. As someone who provides services to my clients in this state, I know I am not required to charge sales tax either. Can you please provide a reference to where your lawyers have advised you that sales tax for services are required in the state of Illinois specifically, and all other states in general?

Nemanja Aleksic

Hi Marcel,

We should have emphasized in the article that a large majority of our users base is not subject to taxation, but in order to figure that out, we need to know your address first 🙂

There’s also the physical presence factor – we’re ramping up our physical presence in the US, which will possibly be interpreted as nexus in the future.

Here’s the reference for Illinois. as far as I can see, you’re in the clear:

Sales Tax – Illinois charge a sales and use tax for the sale of tangible personal property in the state. 35 ILCS 120/1–14. Currently, there is no sales tax on services in the state. Nexus requires a physical presence within the state of property or employees., but can be created presumptively if the remote seller has contracts with residents for commissioned referrals and makes more than $10,000 in sales. 35 ILCS 105/2(1.1)

We’re linking up the address info to a specialized tax company’s API to automatically determine the tax rate. The final tax rate will be visible as soon as we add the tax field to the Billing page and have a user’s address to determine the tax rate.

Please note that I am not a legal expert, so take everything I say with a grain of salt.

marcel

Great answer! Thanks!

Angel

I am surprised this was not sent as email notification to the users. If you are going to cancel a service and the action is required, you should notify your costumers for every channel you have available.

Also, this will be an increase on the price that you should think too.

I feel that I join this with a lot of promises (auto updates, auto reports, reports in other languages…) and a price and I am still waiting for a skype call to try to fix the several bugs I have reported (cloning, backups, etc).

Now, 2 months later, no one of those promises has been finished (but we have slack yeah! :/) and now the price will grow around a 20% depend on when are you located.

Not happy at all. Considering to hold all the premiums until you start being fair with your clients and earning our money.

Thanks

Ángel

Nevena Tomovic

Hey Angel,

Thanks for your comment. With regards to the notification, apologies for this. We put it on our dashboard as the main notification. The article is here just to give some explanation.

With regards to the Skype call, I notified our Customer Happiness team, and they will get back to you with the next step.

We can’t do much about the tax charges, we have to comply with the tax laws of all states and countries. We feel it’s the right thing to do, and unfortunately we can’t impact the % of tax. Auto security check is up next, and in our list of features we are focusing on automation.

Sorry that you feel that we are not being fair, hopefully we can make this up to you soon.

Regards,

Nevena

Angel

I think you could do better here.

You should send an email to all your users before to disable their premium addons.

You could absorb that % of VAT for the actual users, and still comply with the rules.

New users like me joined with a price in mind and now you raise it without notification. If you want to comply with regulations, I would like to let you know that in Spain, it is forbidden to show prices without the VAT, so people does not get surprises like this one.

So, yeah, you could do better I think.

Nevena Tomovic

Dear Angel,

Thank you for your insight.

Apologies we didn’t let you know earlier.

Regards,

Nevena

Angel

Now I got an email.

🙂

That makes more sense.